To paraphrase the movie “Dr. Strangelove,” 2021 was the year people around the world learned to stop worrying and love their connected electronics. For the first time in five years of researching connected consumer behaviors, Assurant’s Connected Decade study shows a majority of consumers across every generation have a positive view of connected technology.

This is true not only in the U.S., but in other major countries across the globe as well. Consumers in Canada, the U.K., Japan, Germany, Brazil, and Australia share similar sentiments.

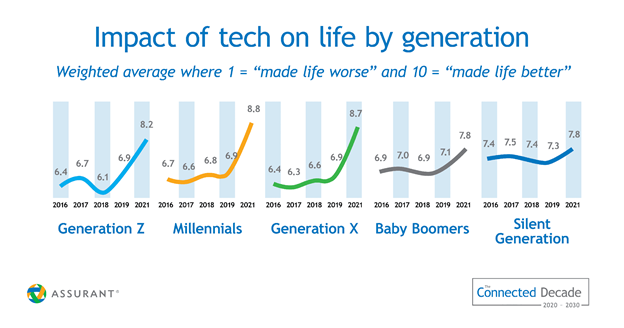

Unsurprisingly, Millennials and Gen Z lead the way in their affinity for technology. What’s interesting is that the lion’s share of baby boomers and the silent generation – who have been more pessimistic in the past – now agree that connected consumer technologies have made life better rather than worse.

Not only do all generations believe technology is beneficial, but there was also a sizable jump in attitudes in 2021 after remaining relatively steady for the previous four years.

On a 10-point scale, with 10 equaling “made life better” and 0 being “made life worse,” the perceived impact of technology increased to 8.6 in 2021 from an average of 6.5 in 2019 among Gen Z, Millennials, and Gen Xers in the U.S. (Fig. 1) Baby boomers and the silent generation also saw the largest rise since 2016.

Fig. 1

One reason for this jump is likely the fact that people became more reliant on consumer electronics with the shift to work-from-home and travel restrictions due to the COVID-19 pandemic. Many people experienced challenges transitioning to working and schooling from home for the first time, especially families having to do both.

Others faced worries from socially isolating, especially baby boomers and the silent generation. Connected products enabled them to keep in touch with children, grandchildren, and friends, while new telehealth applications provided a safe, convenient way to make doctor visits from home.

As people began to rely on remote services, they became more willing to purchase consumer electronics to support those services. Not only did they purchase equipment for themselves, but nearly a quarter (23 percent) also bought a smart product for someone in their family.

This change in attitudes and purchase behavior has opened up new market segments that were lagging in adoption pre-pandemic, and provided an impetus for consumers to expand into new connected product categories they hadn’t considered previously.

For example, the need to be connected has helped turn former technophobes into buyers. Once fearful of new technologies, this group has experienced the benefits and convenience of grocery and food delivery, seeing their doctor from their own living room, and having more personal and meaningful interactions with their family over long distances.

That’s not to say this group doesn’t continue to have concerns about technology. Assurant’s survey shows they still fret over connecting smart products to Wi-Fi, understanding how to replace a broken product, and data security. Offering consumers access to an integrated platform that delivers onboarding help, tech support and identity protection can help drive adoption and loyalty.

Younger generations are looking for choice and flexibility of service and support. As people continue to connect remotely, everything from self-service digital solutions to advanced diagnostic product support can spell the difference in attracting initial and repeat business from consumers across age groups.

Giving consumers the confidence to purchase is important, as once they buy a connected product, they tend to remain loyal and buy again. In 2021, nearly 40 percent of U.S. consumers said they very likely will buy a newer model of their connected devices when the next version is released, a 26 percent increase from 2019. An additional 32 percent said they are somewhat likely to buy a newer model.

While Millennials and Gen Xers are the most likely to repurchase, don’t count out the older groups. Half of baby boomers and more than 40 percent of the silent generation said they are somewhat or very likely to buy a newer model.

It comes down to providing the comfort level to make the purchase. Given the complexity of installing, connecting, using, and troubleshooting many connected products, retailers should look to leverage digital platforms that enable consumers to access service and support wherever and whenever they need it. Doing so can pay dividends with each new product model introduction.

Jeff is the President, U.S. Connected Living, at Assurant, a global provider of risk management products and services with headquarters in New York City. Its businesses provide a diverse set of specialty niche-market insurance products in the property, casualty, extended service protection and pre-need insurance sectors.