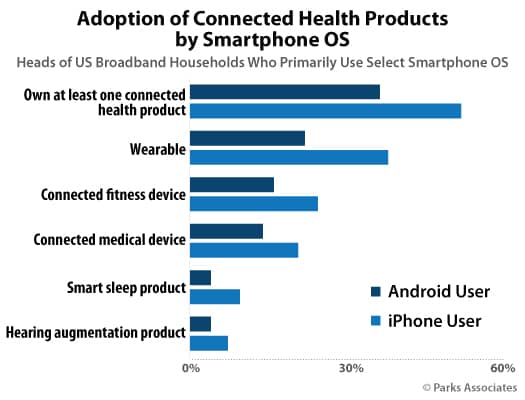

New Parks Associates research finds 49% of iPhone-owning heads of US broadband households also own at least one connected health product, compared to 34% of owners of Android smartphones. Connected Health, Wearables, and Fitness reports that the most commonly adopted connected health product types are wearables such as smart watches, fitness trackers, or GPS sports watches; however, many consumers report high levels of demand for other connected health product types, including connected blood pressure cuffs, Wi-Fi weight scales, and connected thermometers.

“COVID-19 has had a dramatic impact on consumer markets, including health and fitness. Intentions to purchase connected health products are increasing, and consumers report high rates of participation in digital fitness classes,” said Kristen Hanich, Senior Analyst, Parks Associates. “These changes are likely due to inability to be in the gym, reduced appeal of exercising in gyms in general, greater awareness of health risks, and that the industry is introducing more appealing products with a greater range of choices.”

Research conducted by Parks Associates also highlights a growing market for subscription-based fitness services, particularly among younger consumers and smart watch owners. New services such as Apple’s Apple Fitness Plus have launched recently to serve this growing segment.

Connected Health, Wearables, and Fitness tracks the new opportunities for connected health products and services, including the impact of the pandemic on fitness routines, health concerns and attitudes, and purchase intentions in the connected health and wearables technology markets. The research shows the start of a demographic shift in the target consumer for PERS-type functionality. Self-reported panic button adoption is higher among younger consumers than among seniors.

“Roughly 20% of heads of US broadband households currently provide care for a loved one. These caregivers – and their loved ones – represent the traditional PERS market. However, there is a growing market for PERS outside of its traditional demographics,” Hanich said. “Our May 2020 survey found that the mean age of self-reported ‘panic button’ owners was 41 compared to an average age of 50 for non-owners. City dwellers, fitness enthusiasts, outdoor adventurers, and other consumers with security and health concerns represent a ripe market for device makers and service providers.”