To music aficionados and audiophiles of a certain age, the original Sennheiser open-air headphones with their yellow earpads evoke an emotional response comparable to the redolent odor of a new vinyl record or the sensual curve of an SME tonearm. So it’s understandable that the sale of the German audio manufacturer’s consumer electronics division to a large public company came as something of a shock when it was announced in early May.

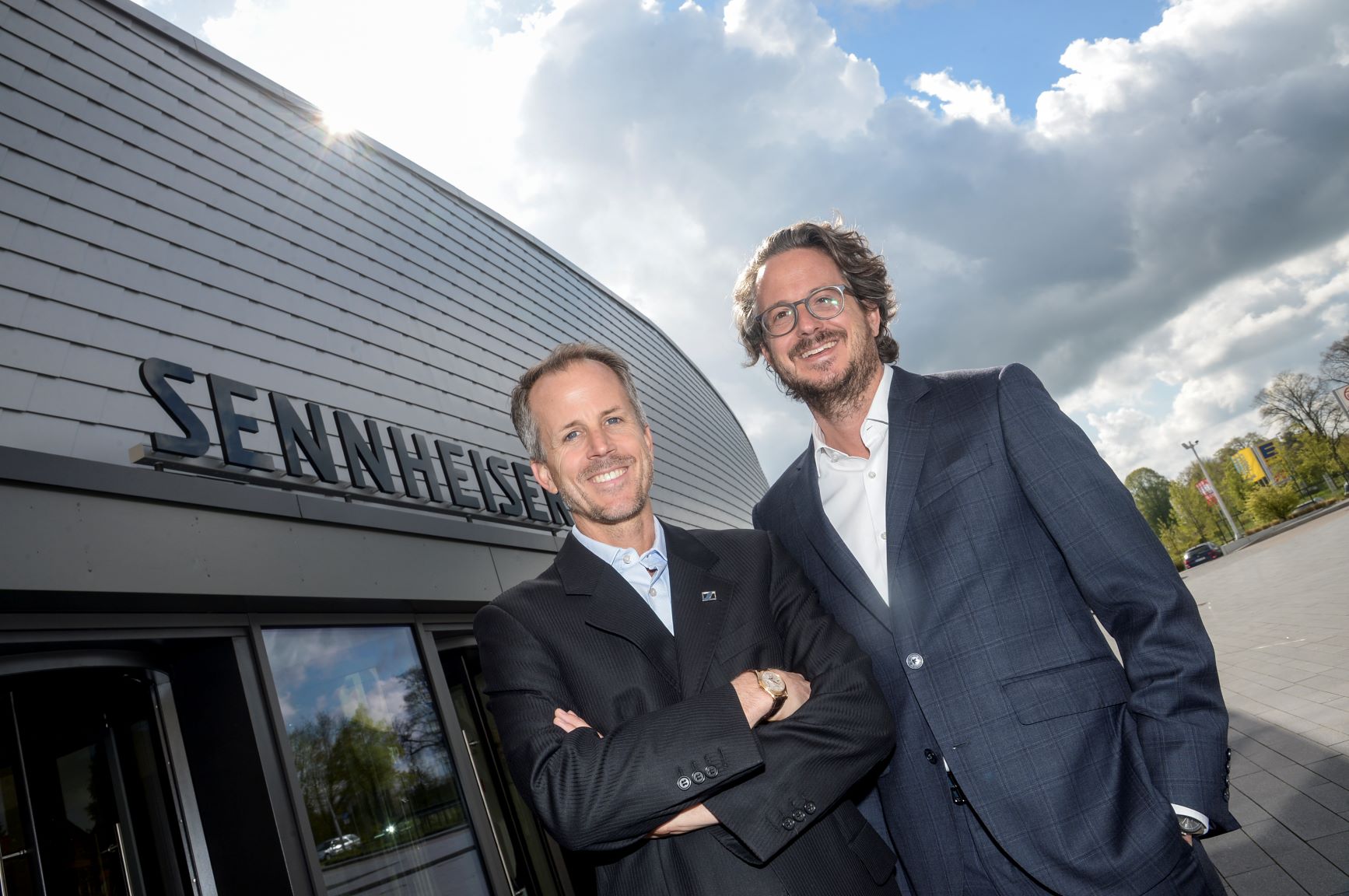

True, the Sennheiser brothers, co-CEOs Daniel and Andreas, have been open for months about their intention to sell the family’s consumer audio business in order to focus on the professional products division, which makes studio monitoring headphones and microphones. But the reality of the change finally arrived with the announcement that Sonova Holding AG, the Swiss-based global hearing aid company, would acquire the consumer electronics part of Sennheiser, which includes its headphone and soundbar products.

“The market has changed, even for the audiophile niche,” said Daniel Sennheiser in a video call with Dealerscope. “The market has become extremely dynamic, with products such as true wireless.”

“And there are new technologies to improve the man–machine interface, like voice commands and curated hearing,” added Andreas Sennheiser. “Is it being used in a noisy environment? In some places, you want the amplification of voices.” The brothers said they recognized that the consumer side needed to grow, but that only a larger company with deep pockets and complementary technology would be capable of the task.

“There’s definitely technology we can share,” said Arnd Kaldowski, the CEO of Sonova, on the same video call. Kaldowski pointed to Sonova’s expertise in miniaturization and its high-end hearing aid business, which includes such brands as Phonak, Unitron, and Advanced Bionics.

For Sonova, Sennheiser’s audio fidelity skills represent access to a new demographic. “In the hearing aid market, the average age of a customer is 71 years old,” noted Kaldowski. By adopting sound reproduction technology from Sennheiser, Sonova could reach a younger generation before hearing loss becomes an issue.“There are people out there with hearing difficulties for whom a traditional hearing aid may not be an option,” points out Ben Arnold, NPD’s consumer technology industry analyst, whereas true wireless earbuds are the kinds of products people are accustomed to wearing and therefore could fill a unique need. Both partners see particular potential in the market for speech-enhanced hearables and for true wireless and audiophile headphones. A recent Arizton Advisory report predicts that the earbud and headphone market alone will grow at an annual rate of 11 percent from now through 2026. How much new investment Sonova is bringing to the headphone business in order to participate in that growth isn’t clear, however. Financial terms of the sale have not been released, but the effect on audiophile sensibilities is clear.

Perhaps the most storied brand in headphones, Sennheiser was founded in 1945 near Hanover, Germany by Fritz Sennheiser, Daniel and Andreas’ grandfather. In its early days, the company began with microphones, but it wasn’t until 1968 that Sennheiser came of age by introducing the first open-air headphone, the HD 414. The five-ounce open-backed headphone was a revelation in a market dominated by heavyweights such as the Koss Pro 4AA, which tipped the scales at a hair-pulling 19 ounces.

The Sennheiser 414 also delivered a different kind of sound, with a wider soundstage that gave recordings more of a live feel. It was a sound that the public liked. an estimated 10 million pairs sold worldwide, the HD 414 became the best-selling headphone of all time. Today, even though Sennheiser no longer produces the HD 414, the company still sells replacement earpads for owners.

In the 1970s, Sennheiser strengthened its sonic reputation by introducing the HD 424 open-air headphone. With larger and more accurate drivers, the HD 424 delivered a more balanced bass response and a warm, natural sound that fans of vintage audio equipment still claim surpasses much of what’s available today. For audiophiles snapping up high-fidelity stereo equipment at the time, the breathlessly accurate HD 424 was nothing less than a trip to the moon on gossamer wings.

There is no question the headphone business has gone through considerable upheaval since then, particularly with the 2008 introduction of Beats of a bass-heavy sound profile. Since then, just about every audio brand has jumped into the $300 headphone market. And now more users are discovering the freedom of true wireless earbuds with the likes of Apple’s AirPods.

“True wireless has become the central focus of the stereo headphone market,” said Arnold. “Sales in the segment are up 20 percent in the 12 months ending March 2021.” Arnold notes that while consumers are moving to lower-cost products, they still care about high-end features and sound quality.

“We understand there are different segments,” emphasized Kaldowski. “We have no interest to dilute to the lower end of the market.” Kaldowski pointed out that Sonova has focused on the high end of the hearing aid business and is looking at new technologies to improve streaming audio for audiophiles, too, and help them with ways to avoid hearing loss. “Active speech enhancement functionality is next,” he said.

As for the Sennheiser brothers, they plan to build on the professional audio business. Along with open-air headphones, the ’70s were also a time when Sennheiser cemented its sonic reputation with its microphone business, catering to the likes of Led Zeppelin, the Rolling Stones, and Johnny Cash. Today, the company also owns another legendary microphone brand, Neumann. The Sennheiser brothers told Dealerscope that they planned to focus on this part of the business as well its aviation products.

As for Sennheiser’s existing research facilities in Wennebostel, Wedemark, near Hanover, Kaldowski said Sonova has no plans to move the department at this point in time. While the hearing aid firm is headquartered in Stäfa, Switzerland, just outside of Zurich, Sonova has divisions around the world that can take advantage of expertise in particular areas, of which Sennheiser’s respected audio research will remain an integral part. Currently, there are about 600 employees in the consumer electronics division of Sennheiser.

Daniel and Andreas insist the Sennheiser brand will persist and prevail. Sonova has made licensing arrangements for the future use of the brand. While details about the direction of future audio research have yet to be hammered out, Andreas Sennheiser says that impressive new models will continue to appear in the near term. Indeed, the company just announced the debut of a new set of audiophile-grade wired earbuds, the IE 900 ($1,300), which were just released this month.

“And not to worry, your HD 650 will continue to exist,” said Andreas, referring to one of Sennheiser’s most well-regarded over-the-ear headphone models. “The entire market should rest assured that we will maintain our entire audio competency.”

Daniel Sennheiser concurred: “We’ve been good at understanding what the audiophile needs, and that’s not going to change,” he said. “There will always be audiophiles.”

SUMMARY:

- Founded in 1945, the legendary German audio company will sell its consumer electronics division, which makes headphones, to Swiss hearing aid conglomerate Sonova.

- The sale will help the Sennheiser brand take advantage of the burgeoning headphone and earbud market, which is growing at an annual rate of 11 percent through 2026.

- With new access to a younger demographic accustomed to earbuds, Sonova will expand beyond its high-end hearing aid focus to develop technologies that help music lovers prevent hearing loss.