Consumer confidence is a regular barometer that many business and data analysts turn to on a monthly basis to gauge how the economy is performing. Consumer insights, while certainly important, only paint half the picture. That’s where, a little over a year ago, Nationwide Marketing Group stepped in to provide some additional color. Last August, we launched a survey among independent retailers that aims to capture their confidence as business owners. These individuals, who certainly have a finger to the pulse of their communities, help us understand the challenges they face, what factors impact their confidence and more.

And now, 13 months in, we’re excited to have a partner in Dealerscope, who can help us to expand that scope by including a wider audience and capture data around some unique topics.

So, get used to seeing these monthly tidbits dropped on these pages — because we’re excited to start sharing them!

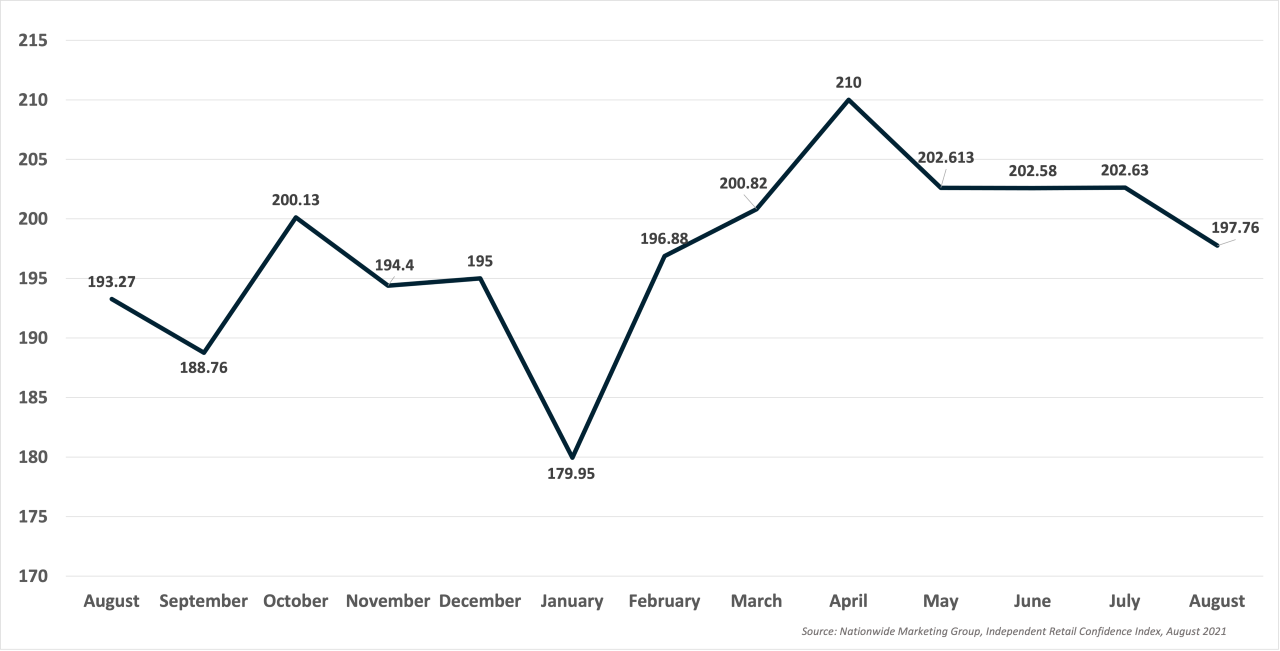

Let’s play a little catch-up, first. Here’s a look at how the CE retail confidence has ebbed and flowed over the past year.

On the surface, these numbers might not mean much. But what we’ve come to learn over the past year is that we’re establishing a baseline. The real excitement with the NMG Index picks up this year as we start looking at year-over-year trends. For August, as an example, we see that CE retail confidence jumped 4.49 points year-over-year.

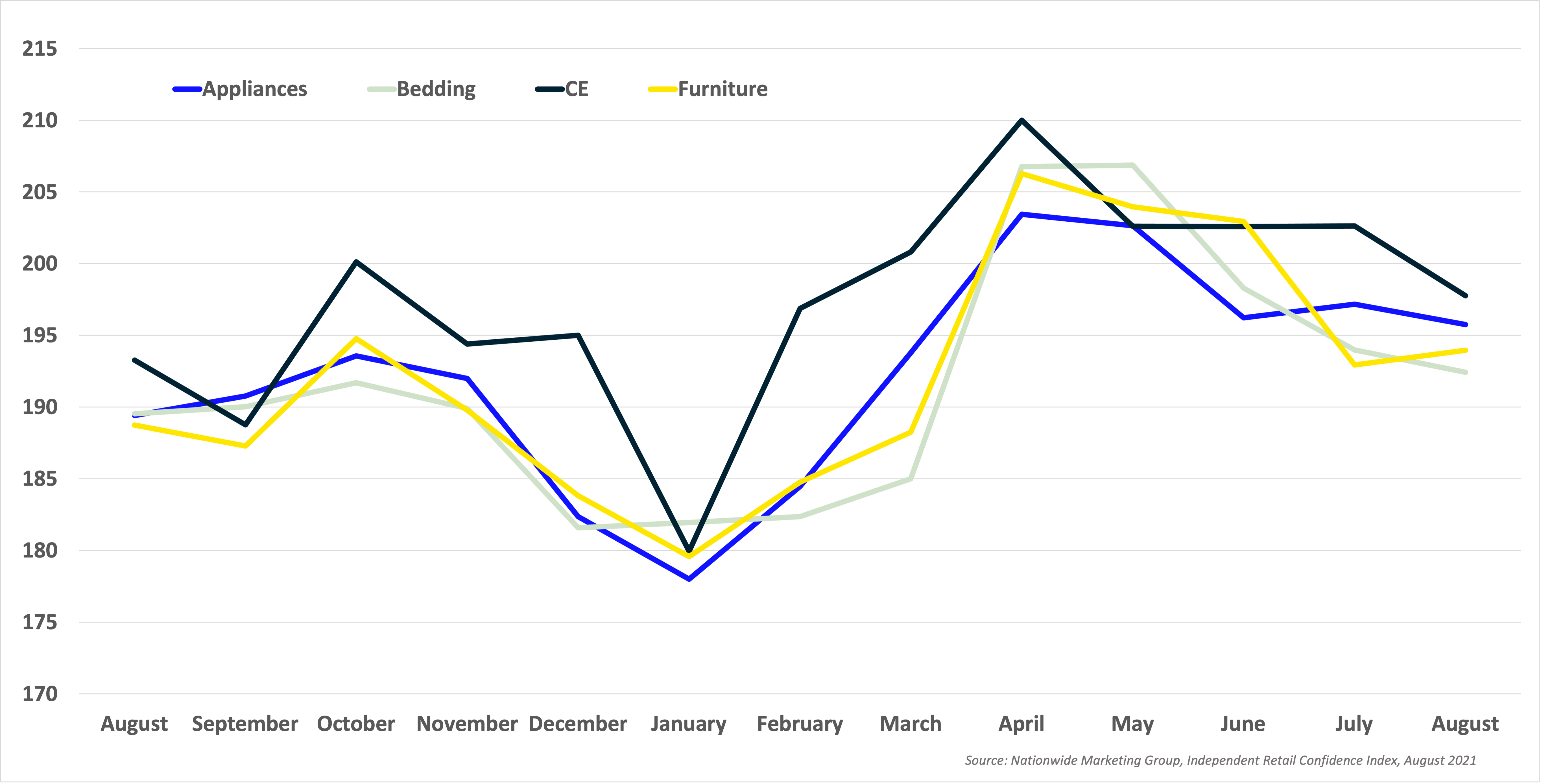

Compared to the other categories we include in the NMG Index survey (Appliance, Bedding, and Furniture), CE retailers have paced the field. This channel has produced the highest monthly score in nine of the 13 NMG Index reports to date. Overall, CE retailers have averaged a monthly score of 197.29, over 5 points higher than the next closest category.

Through open-ended responses we’ll be able to understand why the mountains and valleys appear as they do over the course of the year. The December-to-January dip visualized above was driven by the surge in COVID cases at the time and strict lockdowns being put in place — thus, severely impacting foot traffic and retailers’ ability to sell.

Speaking of COVID…

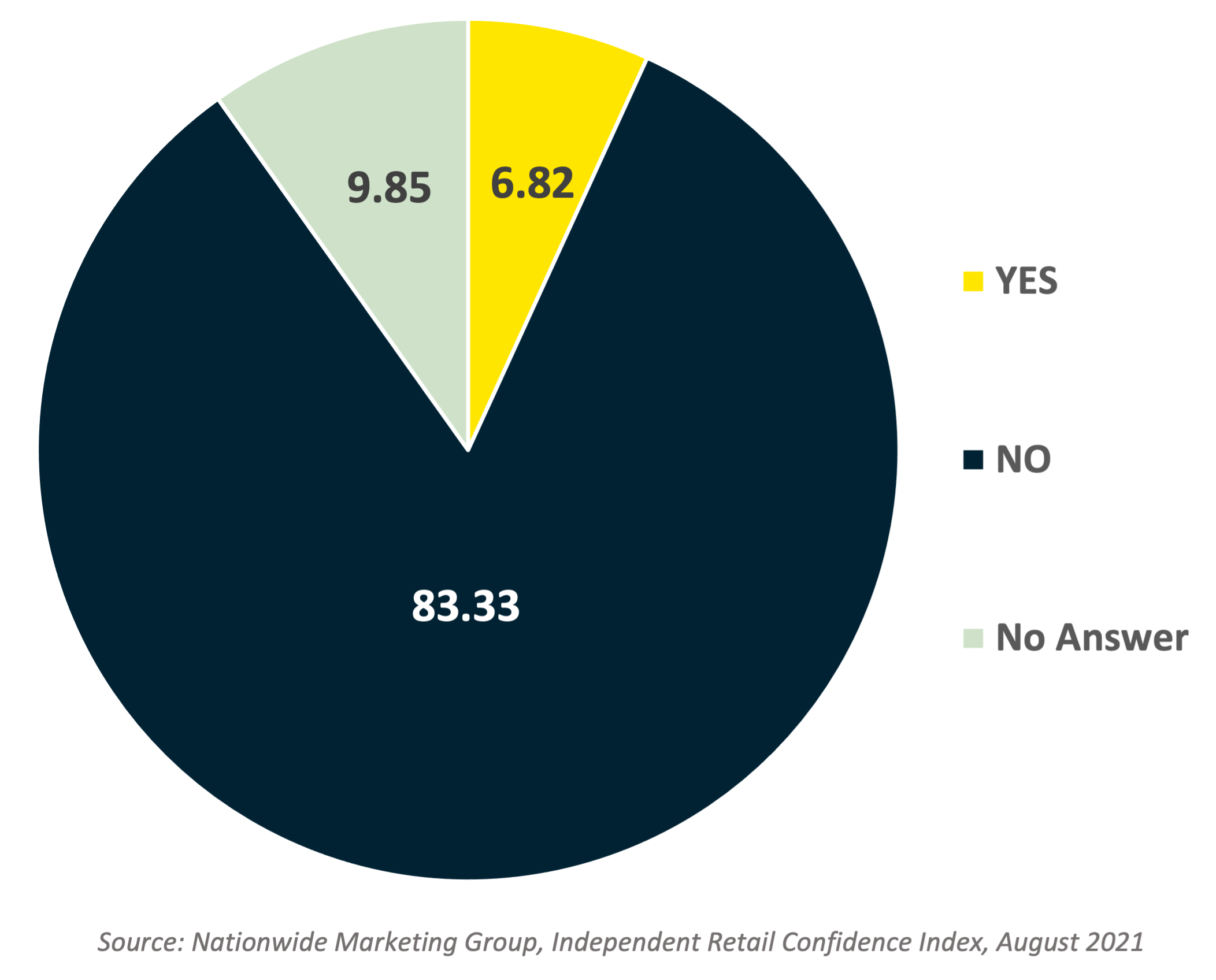

To kick off this NMG Index partnership, we posed a Dealerscope-pitched question to our survey takers: Would they be requiring employees to get a COVID-19 vaccine before returning to work? Their answer was a resounding, “No.”

Retailers strongly stated that they believe vaccination is a personal choice and not something that should be up to them to decide. “Vaccines are a personal choice,” said one retailer. “It’s not in the interest of the company to control any aspect of an employee’s personal life.”

That said, many reported that they’ve encouraged their employees to get vaccinated. A vast majority of respondents report that they, themselves, are vaccinated and that most if not all their regular staff members are as well.

“We’ve left it up to the employee to decide if they want to get vaccinated,” one retailer responded. “In doing so, we’ve seen roughly 90% of our employees opt to get the shot.”

Several retailers did mention having policies in place where unvaccinated individuals in their stores — whether they were employees or customers — were required to continue wearing masks.

Aside from personal choice, labor challenges also seem to impact that decision. A number of retailers said that they feared the possibility of losing critical staff members if they were to require vaccination. Want more NMG Index data? Check out the full NMG Index report.