Since the introduction of the iPhone, consumers have become accustomed to upgrading their smartphones as new models become available. They also have tended to become loyal to one brand, e.g. Apple, Samsung, etc. We are starting to see the same behavior transfer to connected products. Research from Assurant shows that repurchase intent for the same brand or type of product is high after the initial purchase.

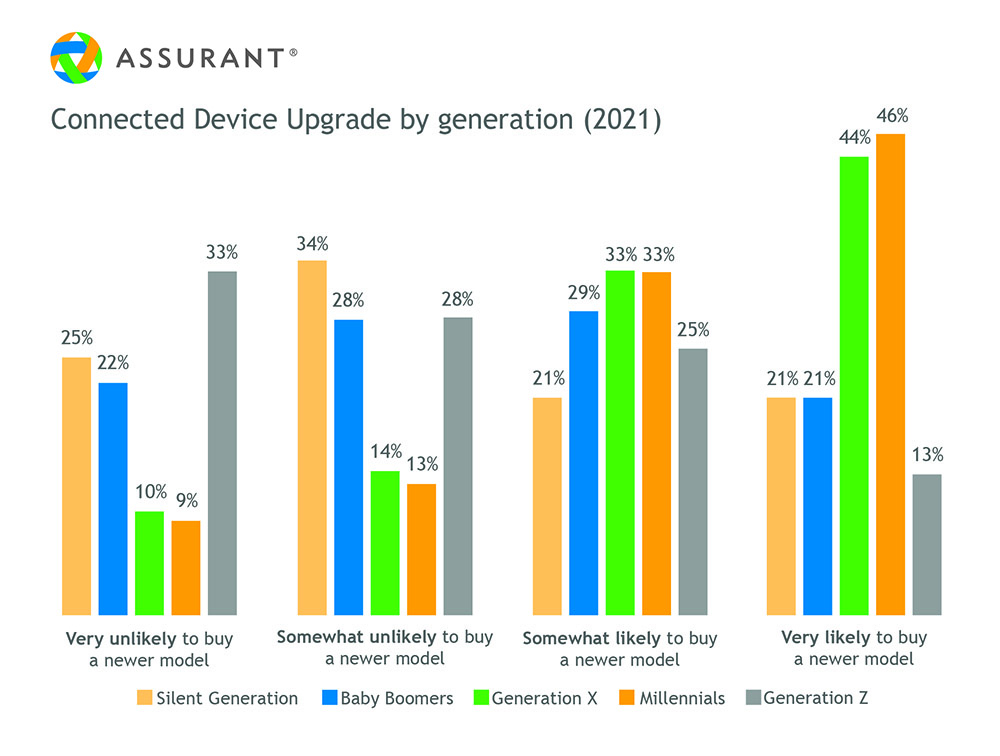

Nearly 40 percent of U.S. consumers in 2021 said they definitely planned to buy a newer model of their connected devices when the next version is released, a 26 percent increase from 2019. Those who said they were definitely or likely to upgrade when a newer version becomes available exceeded 60 percent in 28 of 29 connected product categories. Not surprisingly, Gen X and Millennials are the most apt to upgrade.

The trend is most prevalent for products that see significant change with each new generation or are driven by seasonal demand such as holiday gift giving. It also applies to products that rely on rechargeable batteries, where the user experience can decline over time as the battery degrades.

Think of smart toys, smoke detectors, door locks, baby monitors and watches, where at least 69 percent of owners said they would upgrade. Even at the lower end of the range, a full 45 percent of Bluetooth headset owners indicated they would upgrade.

Give Consumers the Confidence to Purchase

While it’s clear that once consumers buy a connected product, most tend to remain loyal and buy again, the challenge is getting people comfortable with purchasing and using the devices in the first place.

Finding that comfort level requires knowing what makes consumers nervous about purchasing. Even though technology has become more prevalent in our lives, consumers’ intent to buy has continued to exceed ownership in the majority of connected product categories.

What’s holding them back? When it comes to the purchase and usage of connected products, primary barriers relate to connecting, installing and support. A common thread is the fact that the consumer experience after the sale did not match expectations. This, in turn, can lead to elevated returns and limited chances for future upgrades.

In 2021, the top cited frustrations were:

• Problems connecting to Wi-Fi or smartphone (22 percent).

• Insufficient troubleshooting resources (18 percent).

• Fear that the item would break (17 percent).

• Troubles with installation (14 percent).

While consumers have voiced these frustrations consistently over the last five years, issues with connecting to Wi-Fi or a smartphone jumped 83 percent from 2019 to 2021. This likely was due to increased connectivity needs caused by the onset of the pandemic.

In 2021, 66 percent of consumers connected at least one new or replacement device to their home Wi-Fi for the first time, a 65 percent increase from 2019. Of those who did, 25 percent experienced initial setup challenges, 19 percent said they had internet connectivity issues and 16 percent couldn’t connect to Wi-Fi or their phones. Overall, frustrations span both demographics and income. Only technophiles have less concerns.

While these issues can disrupt the relationship between the consumer and the retailer or OEM, research shows that post-purchase support can improve loyalty and give people the confidence to buy no matter where they purchase. Even though purchase intent has largely stagnated over the past five years, consumers increasingly are saying they would buy if they had the peace of mind that comes from complementary services such as technical support, extended warranties and identity protection.

In 2021, 70 percent of consumers surveyed said they’d be more likely to go through with a connected product purchase if given one or more of these value-added services. That number has steadily risen from 61 percent in 2016.

Providing consumers easy access to personal guidance on how to install, connect, use and troubleshoot a purchased product has proven to produce high net promoter scores (NPS), turning customers into advocates who actively refer others.

Perhaps it’s not just a coincidence that, on average, technophiles own the most connected products per household and are the most frequent buyers of premium tech support and smartphone protection programs.

Extending the customer relationship from the initial sale to when they might consider upgrading is a smart move when you consider the complexity of installing, connecting, using and troubleshooting many connected products. Providing helpful support can engender trust and loyalty that can pay dividends with each new model introduction.

This approach has proven successful with smartphones, as it provides customers with assurance and added value from the moment of purchase. The consumer electronics industry has much to gain from taking the same tact.

Jeff is the President, U.S. Connected Living, at Assurant, a global provider of risk management products and services with headquarters in New York City. Its businesses provide a diverse set of specialty niche-market insurance products in the property, casualty, extended service protection and pre-need insurance sectors.