It is a well-known truism that nothing succeeds like success. This maxim certainly applies to the modern smart home, where a new category of connected devices has been rapidly growing in adoption since 2014.

This phenomenon has not been accidental. Parks Associates data indicates that 88 percent of U.S. households currently have broadband access. The pervasiveness of broadband access in the typical household has created a fertile ground for connected appliances, electronics, and other smart devices. Parks reports that 34 percent of broadband households own at least one connected device, with consumers owning an average of 13 connected devices (of any type) in their home, up from 9.2 in 2016 — a dramatic 41 percent increase in less than five years.

Supercharging the smart home has been a rising desire by consumers to address and solve problems in the home. While the technical landscape of the smart home has been evolving (and continues to), new and existing homes must be “reimagined” with connected devices in mind.

Parks Associates recently engaged with GE Appliances to develop a white paper that identifies the opportunities, headwinds, triggers, and dynamics in addressing the macro smart home opportunity. Many of the white paper’s chief findings and insights conjure up a whole host of topics that smart home companies should heed in their mission to address this growing but challenging technology category.

Smart home device demographics

Parks Associates’ research has identified convenience, comfort, and peace of mind as the central factors driving adoption. These primal factors have been abetted by traditional marketing attributes like increased brand/product awareness and co-marketing partnerships (particularly in legacy industries like energy providers, insurance companies, and energy providers). The smart home space, from its origin, has always had a DIY (Do-It-Yourself) guise, with the ensuing installation and setup consequences that early adopters and fast-follower consumers are willing to accept.

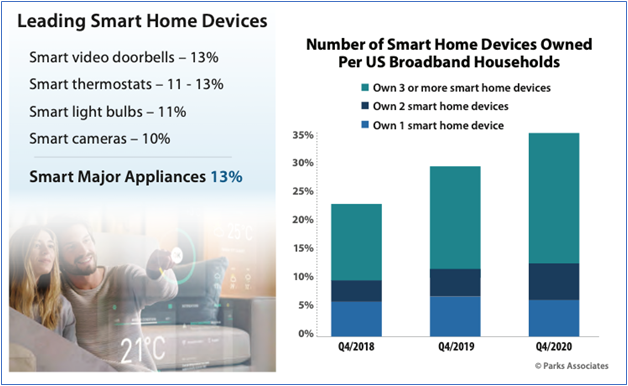

Nevertheless, the overall percentage of U.S. broadband households owning three or more smart home devices increased by more than 64 percent in the past two years, up from 14 percent in 2018 to 23 percent at the end of 2020.

It is hard to argue that COVID-19 has not played a central role in the scorching growth of video doorbells, as stay-at-home consumers (increasingly working from home) found unique appeal in the ability to monitor online deliveries and observe visitors to their homes, often in a remote manner. Parks data indicates that video doorbells experienced the highest growth level — up 86 percent over the past six years — of the most popular smart home devices. Contributing to the appeal of video doorbells, especially with the rise in crime in many urban and suburban areas around the United States, is the product’s ability to facilitate the overall safety of their neighborhoods by posting crime-solved videos of nefarious activity.

Interestingly, while smart thermostats did not relinquish their leading position for smart home devices before 2020, adoption growth for those devices is now at par with video doorbells. Smart light bulbs and smart cameras continue to remain relatively popular (the latter due to rising concerns about residential security). An increasing number of mainstream consumers recognize the remote monitoring value proposition and the ability to get notifications when homeowners are away.

The top triggers driving smart home device purchases

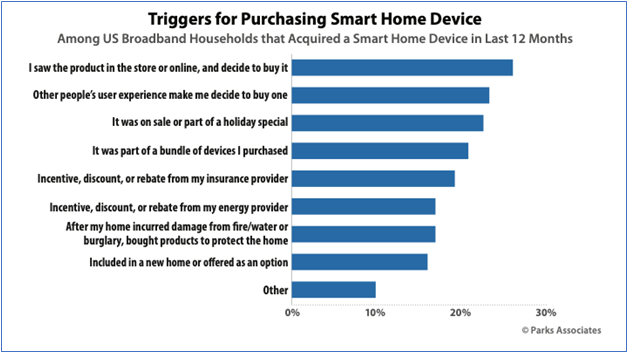

Traditional product awareness continues to play a critical role that is fueling smart home device buying behavior. Smart home device visibility at brick-and-mortar retail stores, as well as online awareness, is the top purchase catalyst. Like many other technology-based products, smart home device buyers often look to other consumers’ experiences as a significant buying criteria factor.

Surprisingly, other traditional and customary marketing techniques like holiday specials/promotions, bundles, and other price-based incentives are somewhat influential, though not in the top consideration set as fundamental awareness and other’s people’s experiences are. This phenomenon could be explained by the average consumer’s desire to focus on real smart home problem solving rather than pricing or promotion “gimmicks” that are often effective with other types of products.

Smart home products imbue consumer lifestyles

Parks Associates’ research has underscored the epiphany that smart home and connected appliances and devices establish profound assimilations into consumers’ lifestyles. It is quickly becoming apparent that consumers are comprehending smart home devices in their domiciles and lifestyles in a manner so embedded it has become difficult for them to imagine what life was like before the dawn of the smart home era. It is not hyperbolic to state that smart home consumers are beginning to perceive video doorbells, intelligent thermostats, and smart light bulbs (just a few examples) as being as critical as “can’t live without” elements such as air conditioning, cell phone service, and indoor plumbing.

What are the key implications?

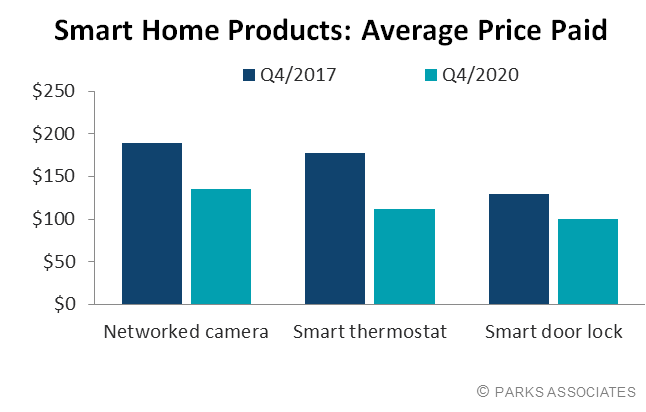

It is essential to point out that smart home and connected appliances and devices have primarily been an early adopter phenomenon. This market condition is likely to change in the not-too-distant future as more mainstream consumers, often not technology-savvy, begin to comprehend and accept the benefits of the smart home value proposition. In addition, lower price points and integration of products, creating and enabling new value, will help increase adoption of connected products.

More compelling, impactful, and pragmatic marketing messaging can play a massive role in accelerating the appeal of the smart home. Consumers and households with modest (and less disposable) income levels are likely to adopt smart home technology only when they fully appreciate the usage model benefits. Home builders must comprehend the integration of these new technologies into their home design plans. Moreover, as 30 percent of U.S. broadband households live in MDU (multi-dwelling units), this is a clarion call for multi-family managers to integrate smart home capabilities into their properties to drive improved operational efficiencies through remote energy and access control management. For building management companies, the good news is MDU-based residents are willing to pay enhanced premium fees for smart home services and rentals that are smart home “friendly,” according to Parks’ research.

To learn more about new smart home products, the connected consumer lifestyle, and the future of modern living, download and view Parks Associates’ Smart Products: Building The Modern Home white paper.

Mark N. Vena is the senior director of the Smart Home & Strategy practice at Parks Associates.