Sustainability initiatives in the retail world have been largely driven by consumer preference in recent years, especially from younger generations. But how much are people willing to pay for eco-friendly products when many personal budgets are tight in a challenging economy?

The National Retail Federation (NRF) recently pointed to a survey that showed more than half of U.S. consumers think sustainable products cost too much. The “green premium” – the added costs from more sustainable production – is said to be giving people pause.

Yet, Assurant’s latest Connected Decade research reveals that 48 percent of consumers were at least somewhat, if not very likely, to pay an optional monthly fee that would contribute to a greener tech industry – even in today’s economic climate. There are several factors working together that could be driving this.

Consumers are E-Waste Conscious

It is no secret that ownership and usage of connected electronics has been growing. It was already on the rise before it received a major boost during the pandemic. In fact, there was a 39 percent increase in 2022 in the number of consumers who regularly use connected products – the third consecutive year of growing usage.

Add to that the growth in the amount of e-waste created as people have purchased more tech products. Nearly 60 million metric tons of e-waste was discarded globally in 2022, according to Statista, and is estimated to surpass 70 million tons annually by 2030. That’s the equivalent of throwing away 1,000 laptops every second for an entire year.

Perhaps consumers are willing to financially support tech industry sustainability initiatives because many know they are contributing to the growing e-waste problem. Assurant research shows that 27 percent of consumers have discarded more than five connected devices in the past five years, while 42 percent disposed of over five chargers and accessories related to their connected devices.

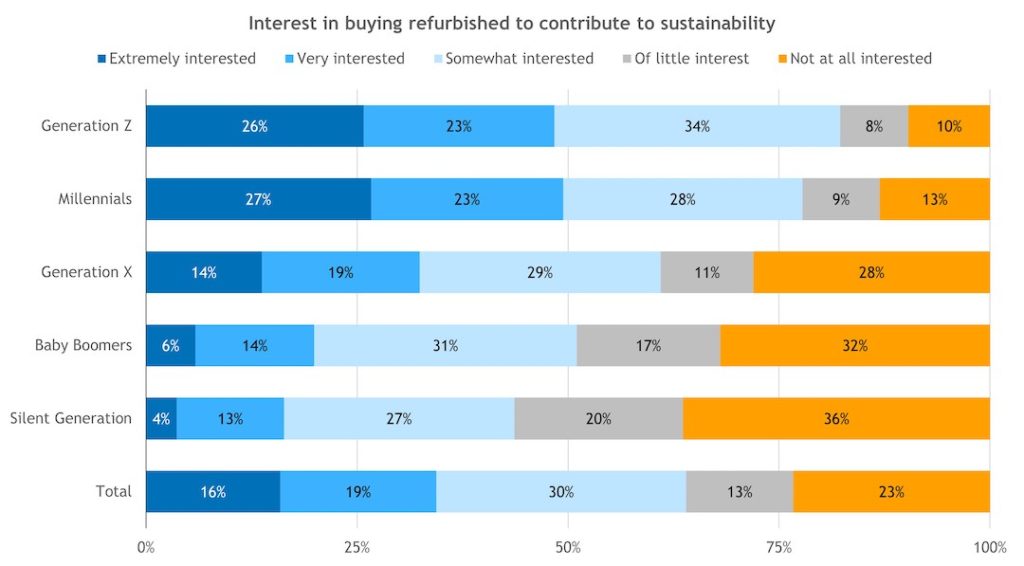

It is also why the appeal of trading items in and buying a refurbished device is gaining steam. Three-fourths (75 percent) of consumers would be more likely to trade in their electronic device if they knew it would be properly reused or recycled. Half of Generation Z and millennials are very or extremely interested in buying a refurbished device as a way of alleviating the pressure on the environment.

That said, the primary driver for consumer desire to purchase a refurbished device is still cost savings. Price (61 percent) was the most important factor among consumers when deciding to buy a repurposed smartphone or other connected product.

This highlights one of the key consumer benefits of trade-in programs – people can watch their wallets while also honoring their good intentions. Based on what we are seeing in the wireless market, retailers stand to gain from making this possible.

How Retailers Can Benefit

Nearly 70 percent of customers with postpaid wireless accounts think that having available trade-in options makes a carrier more appealing. A growing number would be persuaded to switch carriers if offered valuable trade-in promotions (47 percent in 2020 versus 56 percent in 2023). The same is true with staying with their current carrier (42 percent in 2020 versus 60 percent in 2023).

Clearly there is a brand benefit to offering trade-in programs in addition to revenue and profit gains. Consumers are starting to view such programs as a must-have rather than a nice-to-have.

One of the most immediate trade-in opportunities in the CE industry is wearables, given the rapid rise of the category and ongoing smartwatch, fitness tracker, and other device introductions. With a host of product options at a variety of price points, retailers can offer customers appealing incentives to upgrade.

Be aware that wearable trade-in programs require specific technology and logistics capabilities to securely manage and destroy all personal data which might still be stored on these devices. There also should be high standards for deep cleaning of the units for eventual reuse by a new owner.

Lastly, effective channels of distribution are needed to efficiently shepherd these units through secondary markets to new owners to maximize value and limit price depreciation. The good news is that such networks already exist to handle smartphones and can easily be adapted for wider use.

So, are consumers willing to pay extra for greater sustainability in tight times? The answer is that they don’t have to choose. They can pay less for new products by trading in their old devices, knowing that they are saving money while also doing their part to help the environment.

CE providers that can make this happen in an easy, convenient way stand to gain the most from increased customer loyalty and a growing revenue stream.

Jeff is the President, U.S. Connected Living, at Assurant, a global provider of risk management products and services with headquarters in New York City. Its businesses provide a diverse set of specialty niche-market insurance products in the property, casualty, extended service protection and pre-need insurance sectors.