The over-the-top (OTT) streaming video service market is at an all-time high, with consumers benefiting from an abundance of choices from a variety of service providers offering a variety of content and subscription models. For streaming video service providers, the environment is fraught with challenges.

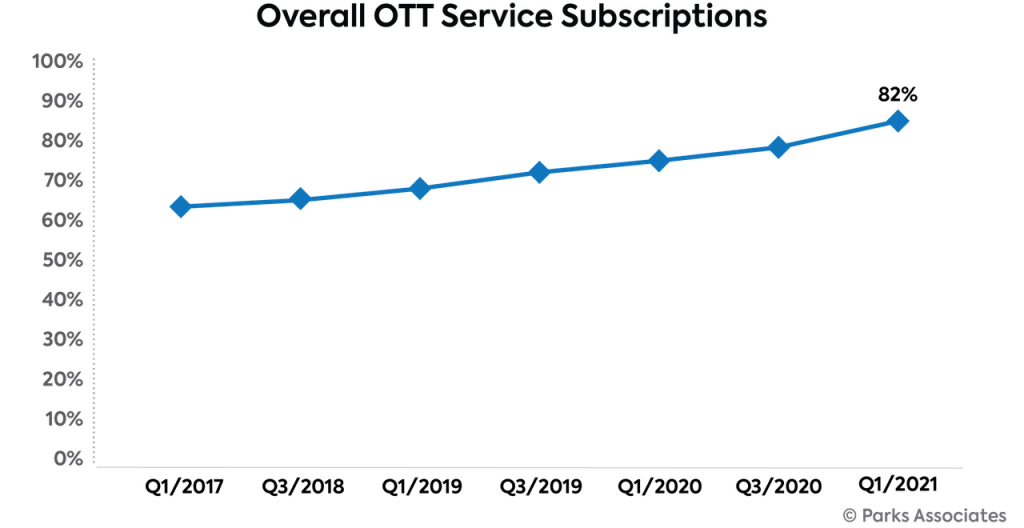

According to Parks Associates’ consumer survey data, the consumption of streaming video services among U.S. households was already accelerating prior to COVID-19, and service adoption continued its ascent during the pandemic. This survey data found that in Q1 of 2021, 82 percent of U.S. broadband households had at least one OTT video subscription, up from 71 percent in Q3 2019.

In the U.S., the percentage of people with an OTT video subscription has surpassed the percentage who subscribe to traditional pay TV. As of Q3 2021, U.S. broadband households now subscribe to an average of 5.6 OTT video services each, according to Parks Associates survey data. OTT video is now the primary way that U.S. consumers access video, and their appetite for content continues to grow. Service stacking has yet to measurably decrease as a result of subscriber fatigue.

As of the first quarter of 2021, nearly half – 46 percent – of U.S. consumers had four or more OTT video subscriptions. In the prior year around that time, it was less than half that, at 22 percent. Eventually, consumers will experience subscription fatigue and start to limit the number of services they will adopt. People have only so many hours and attention they can devote to video. The more services that are competing for pieces of that whole, the harder it is for individual services to be sticky, engaging, and secure in the long term within the service stack.

Subscription lengths and service hopping

The “no-contract model” for OTT services makes it is as easy for consumers to cancel as it is to subscribe. Parks Associates data shows that Netflix dominates the market with an average subscription length of 48 months, but subscription lengths for other video services fall off sharply outside of the top three (Netflix, Amazon Prime Video, and Hulu).

The OTT marketplace is more crowded with the launch of high-profile new services from major studios and conglomerates such as Disney+, HBO Max, and Peacock, and this has made building subscriber loyalty and retention both more difficult and more invaluable.

Video service providers must also contend with subscribers who are especially challenging to retain. Parks Associates research has found that one-quarter of OTT video subscribers are “hoppers” who generally stay with their services for less time, switch services more frequently, have more subscriptions, and cancel more services over a 12-month period compared to other subscribers. Service hoppers are the most demanding subscribers and disproportionately contribute to churn, making them an important retention challenge for today’s video services.

Retention and churn

Retaining subscribers and minimizing subscriber churn are of crucial importance for streaming video services. Parks Associates research shows that OTT services inherently face a higher level of subscriber churn than traditional pay TV services. According to Parks Associates data, the OTT subscriber churn rate in the U.S. as of 2021 is 44 percent.

Content is a primary factor in churn. For services to retain users beyond their initial interaction, regular, relevant, and engaging content is a necessity. Parks Associates research found that 37 percent of subscribers to a new OTT service in the last year indicated that they were planning to terminate their subscription because of a lack of new content. The rise in consumers’ OTT service stacking is indicative of their willingness to intentionally seek out and subscribe to services that provide the content they desire. Stacking, thus, also is a reflection of consumer willingness to churn away from a service, if there is a lack of personally relevant content.

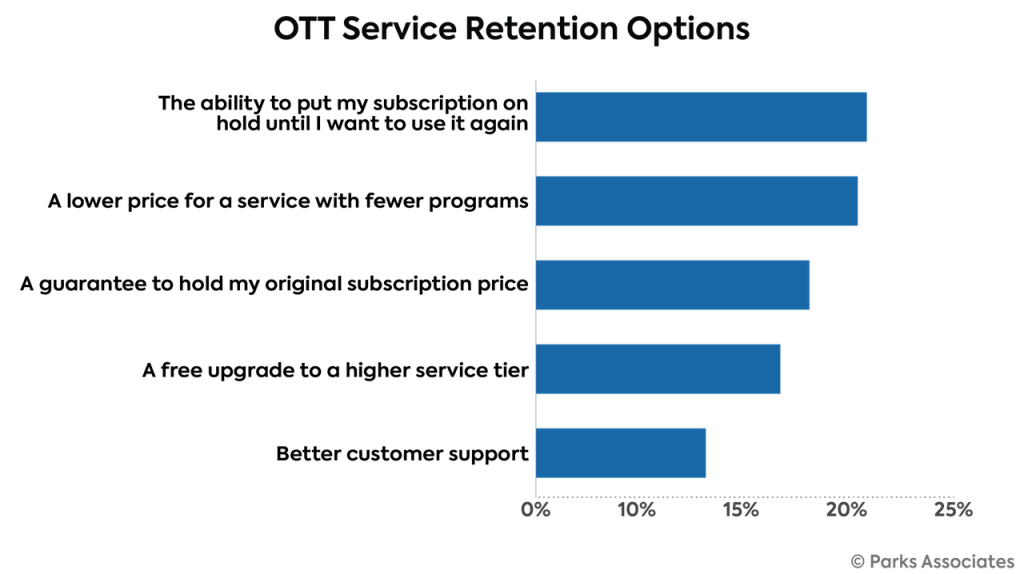

Video services have options available to entice their users. Parks Associates research found that when presented with a list of standard retention options, 21 percent of users referenced the ability to pause a subscription and 21 percent also cited the availability of a lower-priced tier. Given the variety of methods available, and with no single one dominant, the correct selection of retention options to offer an individual subscriber is of high importance in driving successful retention efforts.

With no logistical barrier to consumer churn, services must forge an emotional connection to their subscribers, which is done through a positive combination of content and user experience that drive perceived value.

Video services are seeking ways to optimize the performance of their businesses in as many dimensions as possible. Data, insights, and actions enabled by the application of artificial intelligence (AI) and machine learning (ML) can maximize their abilities to compete and thrive in the current high-pressure streaming video landscape.

This article is an excerpt from the Parks Associates white paper, AI-enabled Data: Key to Video Service Optimization, published in partnership with SymphonyMediaAI. For more information, please visit www.parksassociates.com